Top AI CX Agents in 2025

We analyzed the leading customer experience agents that have raised $100M+ representing $2.9B in total funding.

The CX Agent Boom

Customer experience (CX) is the first real proving ground for AI agents at scale.

From service automation to voice intelligence, companies are replacing traditional chatbots with autonomous agents that reason, recall, and resolve.

In 2025, funding tells the story. The top 13 CX agent companies have raised a combined $2.9 billion. Each one is tackling a different part of the customer journey, from real-time coaching to multi-language voice agents. Together they mark a clear shift toward agent-led support.

Methodology

I focused on companies with over $100 million in total funding that directly build AI-driven CX agents or conversational platforms.

Each company was evaluated on:

Breadth of AI agent capability (text, voice, omnichannel)

Enterprise adoption and customer impact

Public funding data and recent growth signals

The result is a data-backed snapshot of where serious capital and innovation are flowing in customer experience automation.

1. Sierra AI

Sierra AI helps enterprises build better, more human customer experiences through AI agents that handle end-to-end conversations. Founded in 2023, the team is led by OpenAI alum Taylor Smith.

“Our thesis is really simple. We think that conversational AI will become the dominant form factor that people use to interact with brands, not just for the sort of current trends like customer service, but really for all aspects of the customer experience,” Bret Taylor, Co-founder & CEO

A Fortune 500 retailer used Sierra to deploy multilingual voice agents across 12 markets, cutting response times by 60%.

Best for: Enterprises deploying multilingual CX agents.

Funding: $635M

Website: sierra.ai

2. Cresta

Cresta blends AI and human intelligence to boost agent productivity in real time. Its models coach reps during calls, predict intent, and recommend responses.

CEO Ping Wu said the goal is “turning every rep into your best rep.”

One telecom client used Cresta to guide 4,000 agents during live calls, increasing conversion rates by 19%.

Best for: Live coaching and contact center optimization.

Funding: $276M

Website: cresta.com

3. Kore.ai

Kore.ai builds conversational AI agents for enterprises across service, sales, and HR. Its no-code platform powers millions of interactions daily.

Founder Raj Koneru said, “Enterprises aren’t experimenting anymore. They’re standardizing AI agents.”

A global bank automated 40% of inbound service requests with Kore.ai’s voice bots, saving $12M annually.

Best for: Large enterprises standardizing voice and chat agents.

Funding: $262M

Website: kore.ai

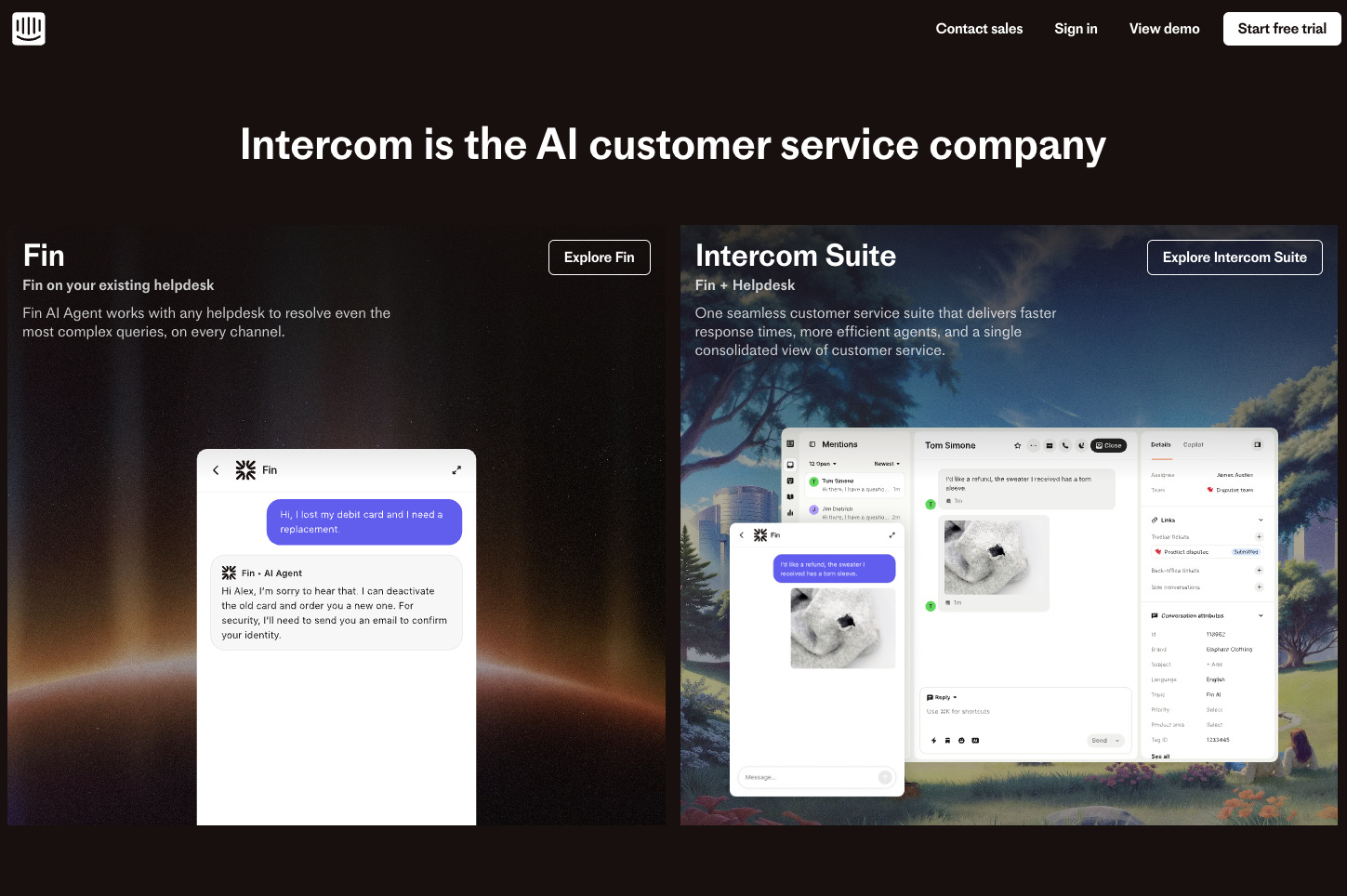

4. Intercom

Intercom transformed from a messaging platform into an AI-first customer service hub. Its Fin AI Agent now handles billions of customer messages autonomously.

CEO Eoghan McCabe said, “Support will be the first function to become mostly AI-run.”

A SaaS firm using Fin cut median resolution times from 4 hours to under 10 minutes.

Best for: AI-first support teams inside SaaS and e-commerce.

Funding: $241M

Website: intercom.com

5. Decagon

Decagon is a new entrant making waves with fully autonomous chat and email agents. Its focus is quality, and each agent is trained to mirror a brand’s tone and reasoning.

“An AI agent is working for you automatically behind the scenes. This is the first time we’ve achieved a technology that is like actually equivalent to hiring someone.” said co-founders Jesse Zhang and Ashwin Sreenivas.

A logistics company replaced 70% of tier-one email volume with Decagon agents that achieved a 94% satisfaction rate.

Best for: Mid-market CX teams scaling high-touch automation.

Funding: $231M

Website: decagon.ai

6. Observe.AI

Observe.AI started in speech analytics and evolved into a full agent performance platform. It monitors every call and automates after-call work with AI.

CEO Swapnil Jain said the next leap is “agents that learn from every customer interaction.”

A call center using Observe.AI reduced QA effort by 80% while improving CSAT by 15 points.

Best for: Voice-heavy service organizations.

Funding: $214M

Website: observe.ai

7. Parloa

Berlin-based Parloa combines enterprise voice automation with native language understanding. It’s built for global companies managing complex service flows.

Co-founder Malte Kosub said, “AI agents need to sound natural everywhere, not just in English.”

A telecom customer used Parloa to roll out German and French voice bots, cutting call volumes by 40%.

Best for: Multilingual, voice-first CX.

Funding: $212M

Website: parloa.com

8. Ada CX

Ada helps enterprises automate customer support across chat, messaging, and social channels. It emphasizes brand-consistent, conversational automation.

CEO Mike Murchison said, “AI should feel like your brand, not a bot.”

One airline used Ada to handle 70% of chat volume during peak travel, maintaining a 92% satisfaction score.

Best for: Brands prioritizing consistent tone across channels.

Funding: $197M

Website: ada.cx

9. Cognigy

Cognigy, based in Düsseldorf, powers AI contact centers with enterprise-grade orchestration. It integrates tightly with CRMs and telephony systems.

CEO Philipp Heltewig said, “The contact center is becoming an agentic platform.”

An insurer built 24/7 voice assistants in six languages using Cognigy, reducing costs by 35%.

Best for: Complex enterprise integrations.

Funding: $165M

Website: cognigy.com

10. PolyAI

PolyAI specializes in natural-sounding voice agents that handle customer calls without scripts. Its models are trained for real conversations, not predefined flows.

CEO Nikola Mrkšić said, “Our goal is voice agents people don’t realize are AI.”

A hotel chain deployed PolyAI across 300 locations, answering 80% of calls autonomously.

Best for: Real-sounding voice automation.

Funding: $120M

Website: poly.ai

11. Forethought

Forethought builds agentic AI that learns from your company’s data to resolve support tickets instantly.

Founder Deon Nicholas said, “The best AI agent is the one that knows your business inside out.”

An enterprise SaaS company saw 35% faster resolution times after deploying Forethought’s Assist product.

Best for: Companies automating tier-one and tier-two support.

Funding: $117M

Website: forethought.ai

12. Yellow.ai

Yellow.ai powers omnichannel CX automation across chat, voice, and social. Its platform serves Fortune 500 companies in over 85 countries.

CEO Raghu Ravinutala said, “We’re moving toward self-driving customer experience.”

A major bank reduced support costs by 30% using Yellow.ai’s hybrid human-AI model.

Best for: Global enterprises scaling hybrid automation.

Funding: $102M

Website: yellow.ai

13. Gorgias

Gorgias focuses on e-commerce. It turns repetitive support tickets into automated workflows while keeping human agents in the loop.

“Every support team wants speed without losing empathy,” said CEO Romain Lapeyre.

An apparel brand automated refund and tracking requests with Gorgias, saving 400 agent hours a month.

Best for: E-commerce customer support automation.

Funding: $101M

Website: gorgias.com

Key Trends in CX Agents

Voice is resurging. Advances in speech synthesis and context awareness have made voice agents viable again.

Agent orchestration beats point bots. Tools like Sierra, Kore.ai, and Cognigy are integrating full agent networks, not isolated chatbots.

Quality over quantity. Decagon and Forethought show that customers value precise, brand-consistent responses more than full automation.

Hybrid human-AI models dominate. Leading platforms blend AI autonomy with human review to preserve trust.

Global language coverage matters. Parloa, Ada, and Cognigy are winning by focusing on non-English markets.

Sources: McKinsey CX 2025 Outlook, Gartner Emerging Tech Radar 2025, Brixo Agent100 dataset.

FAQ

What is a CX agent?

A CX agent is an AI system that interacts with customers across chat, voice, or email to resolve issues, often replacing human Tier-1 support.

How is this different from a chatbot?

Unlike rule-based bots, CX agents can reason, remember context, and adapt responses dynamically.

Which industries are adopting them fastest?

Telecom, banking, and e-commerce lead adoption due to high ticket volume and repetitive inquiries.

Are these agents replacing people?

They’re more often augmenting them, handling routine requests so human reps can focus on higher-value conversations.

What’s next for CX agents?

Expect tighter integration with CRMs, proactive outreach, and real-time sentiment adaptation.

Closing Thoughts

The CX agent market is past its experimental phase.

With billions in funding and real ROI, these platforms are building the foundation for the next decade of customer service.

The real winners will be the ones that make AI feel personal, helpful, and human at scale.